ETH Price Prediction: Path to $5,000 Amid Technical Resistance and Strong Fundamentals

#ETH

- Technical resistance at $4,468 must be overcome for momentum toward $5,000

- Strong institutional adoption and reduced exchange supply provide fundamental support

- MACD signals potential reversal despite current bearish momentum readings

ETH Price Prediction

Technical Analysis: ETH Faces Key Resistance at 20-Day Moving Average

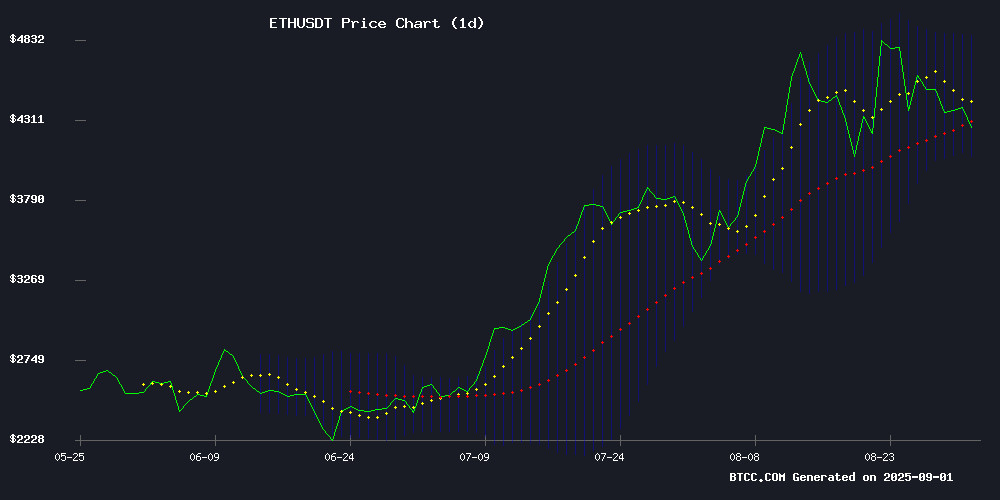

ETH is currently trading at $4,264.27, below its 20-day moving average of $4,467.77, indicating short-term bearish pressure. The MACD reading of -4.05 shows weakening momentum, though the histogram at 107.88 suggests potential reversal signals. Bollinger Bands position the price NEAR the lower band at $4,076.32, with middle resistance at $4,467.77 and upper resistance at $4,859.21. According to BTCC financial analyst James, 'ETH needs to break above the 20-day MA to regain bullish momentum toward the $5,000 target.'

Market Sentiment: Strong Fundamentals Support ETH's Long-Term Outlook

Positive developments including China's landmark $70M tokenized bond issuance on ethereum and Korean investors shifting $253M into crypto favoring Ethereum proxies create strong fundamental support. Exchange reserves hitting 9-year lows indicate reduced selling pressure, while scalability discussions around Plasma vs Sharding highlight ongoing network development. BTCC financial analyst James notes, 'Despite short-term technical resistance, institutional adoption and reduced exchange supply provide strong foundations for ETH's next leg higher.'

Factors Influencing ETH's Price

Plasma vs Sharding: Ethereum's Scalability Race Intensifies

Blockchain scalability remains the defining challenge for decentralized networks, with Ethereum's Plasma and sharding emerging as competing architectural solutions. Vitalik Buterin's Plasma framework proposes a hierarchical system of sidechains that minimize mainchain congestion, while sharding partitions the network into parallel processing segments.

Both approaches aim to transcend Ethereum's current 15-30 TPS bottleneck, though neither has achieved mainstream implementation. Plasma's security model relies on periodic commitments to the mainchain, creating tradeoffs between throughput and decentralization. Sharding promises linear scalability but introduces complex cross-shard communication challenges.

The evolution of these solutions coincides with Ethereum's rising gas fees and growing DeFi adoption. Market observers note Layer 2 solutions like Polygon (MATIC) and Arbitrum are currently outpacing both technologies in real-world adoption.

Is ETH’s Long-Term Bull Run Just Getting Started? This Data Says So.

Ethereum's price trajectory appears to be entering a new phase, closely mirroring global M2 liquidity trends. Analyst Merlijn The Trader highlights the end of ETH's accumulation period below $2,750, with the cryptocurrency now positioned for a potential bull run. The correlation between Ethereum's movement and broader liquidity shifts suggests macroeconomic forces at play rather than speculative hype.

Key resistance at $4,520 remains a critical level for ETH. A decisive breakout could propel prices toward $4,800 or beyond. While September often shows seasonal weakness, historical data indicates Q4 tends to flip bullish, with October through December averaging positive returns.

The liquidity heatmap reveals concentrated sell orders near current levels, but the overarching narrative remains constructive. As global liquidity expands, Ethereum's responsiveness to these macroeconomic currents positions it as a bellwether for the broader crypto market.

China Shenzhen SOE Launches $69M RWA Bond on Ethereum in Historic First

Futian Investment Holding, a state-owned enterprise from Shenzhen, has issued the world's first real-world asset (RWA) digital bond on Ethereum. The 500 million yuan ($69 million) offshore RMB bond carries a two-year tenor, marking a significant milestone in blockchain-based traditional finance adoption.

The MOVE signals growing institutional confidence in Ethereum's infrastructure for capital markets. As RWAs gain traction, this issuance could catalyze further convergence between decentralized finance and regulated financial instruments.

China's Futian Investment Launches $70M Tokenized Bond on Ethereum in Landmark RWA Offering

Futian Investment Holding, a Chinese state-owned enterprise, has broken new ground with the first public offering of a digital bond on the ethereum blockchain. The 500 million yuan ($70 million) issuance marks a significant step in real-world asset (RWA) tokenization, featuring a two-year maturity and 2.62% coupon rate.

The listing on both Shenzhen and Macau exchanges represents a historic convergence of public blockchain technology with traditional capital markets. Unlike previous private placements in Hong Kong, this public offering democratizes access to institutional-grade blockchain investments.

"This initiative capitalizes on Hong Kong's policy advantages while optimizing our global financing channels," the company stated, positioning the move as a catalyst for regional economic development.

Hong Kong-based NVT provided the technological infrastructure for the issuance, with founder Jay Zhao noting: "Tokenization is evolving from experimental projects to large-scale implementations." The deal signals growing institutional acceptance of Ethereum's public blockchain for regulated financial instruments.

Korean Investors Pivot $657M Tesla Exodus Into $253M Crypto Bet, Favoring Ethereum Proxy

South Korea's retail trading community is undergoing a seismic shift as $657 million floods out of Tesla holdings in August 2025—the largest monthly divestment since 2023. The capital is rapidly redeploying toward cryptocurrency markets, with $253 million targeting BitMine Immersion Technologies as a preferred Ethereum proxy.

Market analysts attribute the rotation to eroding confidence in Tesla's AI narrative. "The EV pioneer once inspired our generation, but its innovation pipeline has stalled," remarks Han Jungsu, a 33-year-old retail trader. Bloomberg data reveals Korean crypto inflows now outpace traditional equity outflows by 2.6:1.

TradingView charts illustrate the inverse correlation—as Tesla's volatility-adjusted returns dipped 18% year-to-date, Ethereum-based instruments gained 34% among Korean traders. The migration underscores a broader regional trend where digital assets absorb 72% of reallocated portfolio capital.

Ethereum Demand Stays Strong As Exchange Reserves Keep Falling

Ethereum (ETH) holds firm above $4,400, weathering recent market turbulence with notable resilience. While price action has stalled in a consolidation phase, the tug-of-war between bulls and bears keeps traders on edge. Diverging analyst views paint contrasting scenarios: a retracement below $4,000 to establish healthier foundations, or an imminent breakout toward $5,000 if accumulation patterns persist.

Beneath the surface volatility, on-chain metrics tell a compelling story. CryptoQuant data reveals exchange reserves continue their downward trajectory—a clear signal of strongholder conviction. "The dichotomy between price correction and unabated demand suggests institutional players are quietly building positions," observes analyst Crypto SunMoon. This fundamental strength could foreshadow the next major leg upward once technical resistance breaks.

Ether Gas Fees Spike as WLFI Token Launch Strains Network

Ethereum's network congestion returned with a vengeance as gas fees surged past 100 gWei following the launch of World Liberty Fi's transferable token. The spike marked the highest transaction costs in months, with simple swaps briefly exceeding $145.

The WLFI token rollout served as a stress test for Ethereum's scalability, exposing lingering vulnerabilities to high-profile events. While the network had enjoyed weeks of sub-1 gWei fees, the sudden activity overwhelmed capacity—reminiscent of 2021's peak congestion periods.

DeFi operations bore the brunt of the surge, with bridging and borrowing costs exceeding $100. Even basic ETH transfers required $10 fees. The event demonstrated how single smart contract deployments can still disrupt Ethereum's ecosystem despite layer-2 scaling solutions.

Notably, ETH's price held firm at $4,403.56 during the network strain, underscoring investor confidence in Ethereum's long-term value proposition. The WLFI project plans to expand into lending and governance features, suggesting potential for sustained network impact.

Ethereum Exchange Holdings Hit 9-Year Low as $5,000 Breakout Looms

Ethereum's rally appears poised to extend into September, with on-chain data signaling reduced sell pressure and growing market confidence. Exchange balances have plummeted to 2016 levels, with just 16 million ETH—worth approximately $70.37 billion—remaining on trading platforms. This exodus to private wallets suggests holders anticipate further gains, creating a supply squeeze that could amplify upward momentum.

The long/short ratio now stands at 1.0096, reflecting a decisive shift toward bullish positioning. Such metrics reinforce the narrative of ETH as institutional investors' altcoin of choice, particularly as the ecosystem prepares for major protocol upgrades. The confluence of technical and on-chain factors paints a compelling picture for September's price action.

Ethereum Price Surge: Is ETH's $7K Rally Possible?

Ether reached an all-time high last month, marking August as a standout period for the cryptocurrency. The market now watches closely for potential continuation of this momentum into September, despite historical volatility during this month.

Analysts are divided on whether ETH can sustain its upward trajectory to test the $7,000 level. Market sentiment appears cautiously optimistic as institutional interest grows alongside developments in Ethereum's ecosystem.

ETH Price Analysis: Key Support Battle Determines Next Move

Ethereum's bullish momentum has faltered, with ETH breaking below a critical support level and now consolidating NEAR the midline of its ascending channel. The daily chart shows rejection at the channel's upper boundary near all-time highs, pushing price back to the $4.2K support zone—a confluence of technical significance including a daily order block and mid-channel boundary.

Momentum appears neutral with RSI hovering around 52, leaving ETH in a fragile equilibrium. A breakdown below $4.2K could trigger a slide toward $3.8K demand territory, while successful defense of current levels may reignite bullish momentum toward $4.6K resistance. The 4-hour chart reveals repeated failures at $4.6K, suggesting this level remains the immediate hurdle for bulls.

Crypto Fundraising Slows in August Despite Binance Wallet's Strong Performance

August marked a downturn in crypto fundraising, with both token sales and venture capital investments losing momentum. Data from Cryptorank reveals a decline in the number of deals and their monetary value, signaling a cautious market despite the broader recovery of blue-chip assets.

Binance Wallet emerged as a standout, with its token sales generating the highest returns as investors favored liquid ecosystems. However, the overall trend for initial coin offerings (ICOs) and initial DEX offerings (IDOs) remained bearish, continuing a slide that began in March.

The DeFi sector and Ethereum's ecosystem absorbed much of the market's attention, diverting interest away from new token launches. While Pump.fun's record-breaking ICO in July provided a temporary boost, it failed to reignite broader enthusiasm for token sales.

Only 63 token sale deals were completed in August, raising approximately $53 million—a fraction of the activity seen earlier this year. Skepticism from both projects and buyers, compounded by competition from meme coins, has further dampened the ICO landscape.

Will ETH Price Hit 5000?

ETH reaching $5,000 is achievable but requires overcoming immediate technical hurdles. Currently trading at $4,264, ETH faces resistance at the 20-day moving average of $4,468. Breaking this level could open a path toward the upper Bollinger Band at $4,859, with $5,000 as the next psychological target.

| Key Levels | Price (USDT) | Significance |

|---|---|---|

| Current Price | 4,264.27 | Immediate support |

| 20-Day MA | 4,467.77 | Key resistance |

| Upper Bollinger | 4,859.21 | Next target |

| Psychological Target | 5,000.00 | Major milestone |

Strong fundamentals including institutional adoption and reduced exchange supply support the bullish case, but technical indicators suggest the move may require consolidation before the next breakout.